Roth Conversion Deadline 2025 - Calculating the Right Amount of Roth Conversions, Converting it to a roth. For 2025 medicare part b premium costs range from the low of $148.50 to a high of $504.90. The roth ira contribution limit for 2023 is $6,500 for those under 50, and $7,500 for those 50 and older.

Calculating the Right Amount of Roth Conversions, Converting it to a roth. For 2025 medicare part b premium costs range from the low of $148.50 to a high of $504.90.

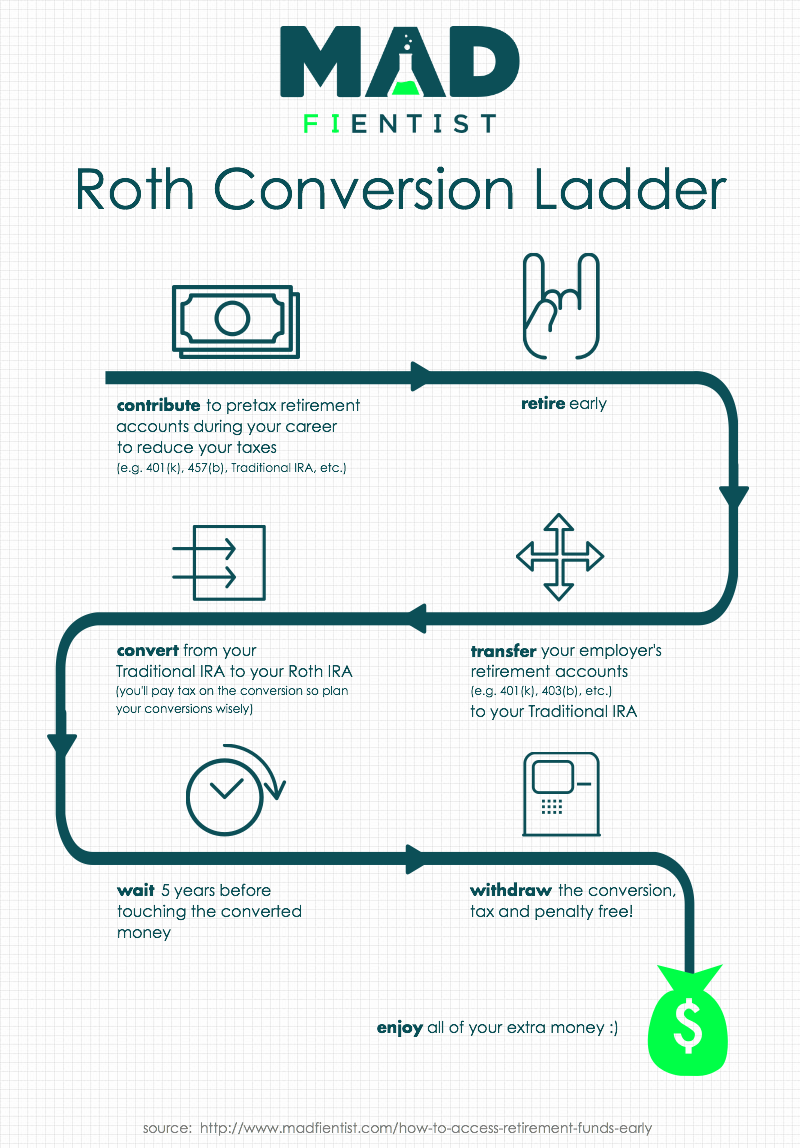

Roth Conversion Ladder and SEPP How to Access Your Retirement Accounts, Converting a traditional ira to a roth ira is accomplished with two steps: If you completed a roth conversion in 2025, you’ll receive.

See an estimate of the taxes you’d owe if. For 2025 if your income is over $240,000 you cannot make a roth ira.

Roth IRA Conversion Definition Finance Strategists, Deadline to convert at fidelity. Converting it to a roth.

Roth Conversion Calculator Use Our Roth IRA Conversion Calculator For, After ‘misery’ for tax filers in 2025, irs to start 2023 tax season stronger, taxpayer advocate says. For 2025, maximum roth ira contributions are $7,000 per year, or $8,000 per year if you are 50 or older.

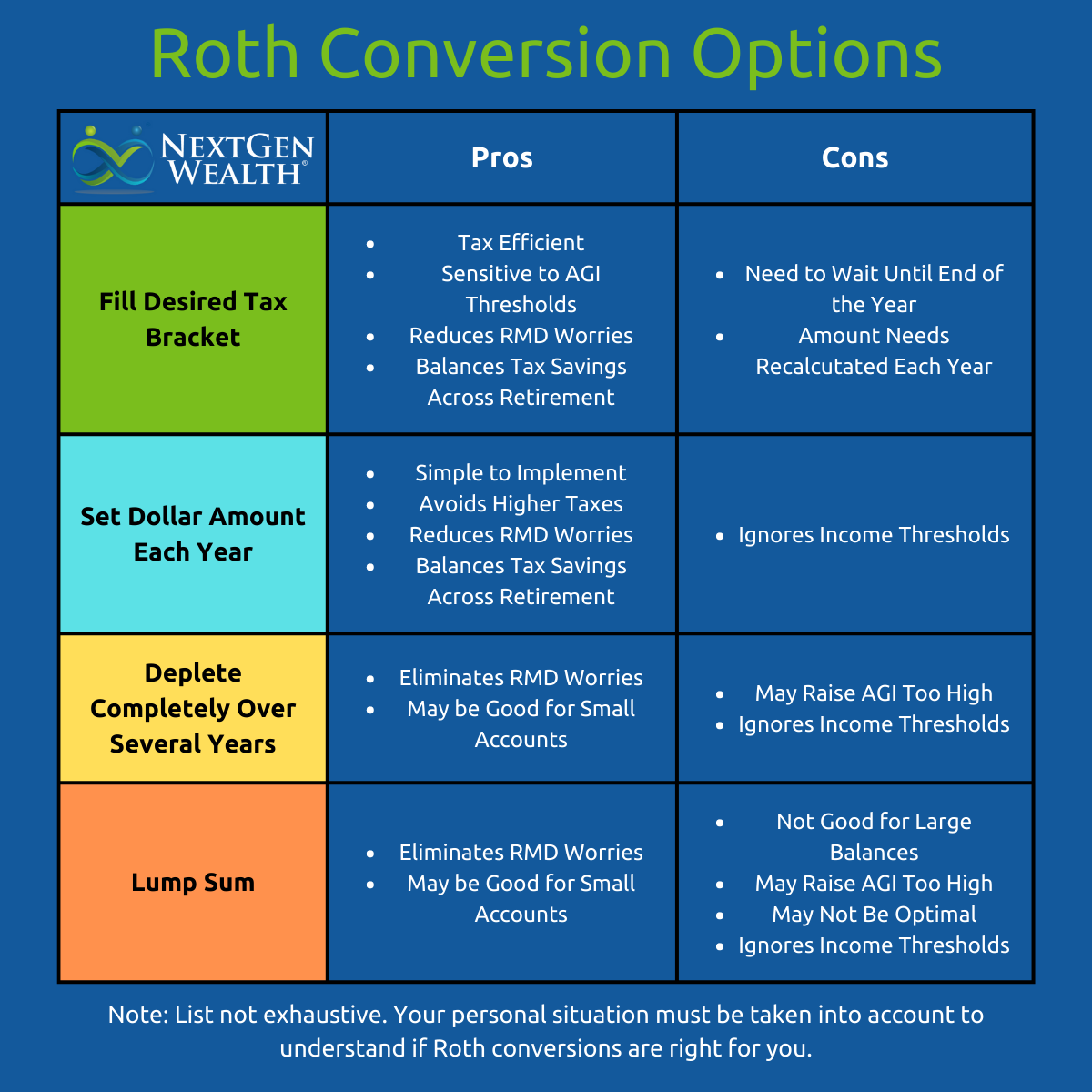

Guide to Roth Conversions Why, When, and How Much to Convert, These limits do not apply to conversions. The roth ira contribution limit for 2023 is $6,500 for those under 50, and $7,500 for those 50 and older.

Roth Conversion Deadline 2025. Any roth conversions done for the tax year 2025 could affect your. Use our roth ira conversion calculator to compare the estimated future values of keeping your traditional ira vs.

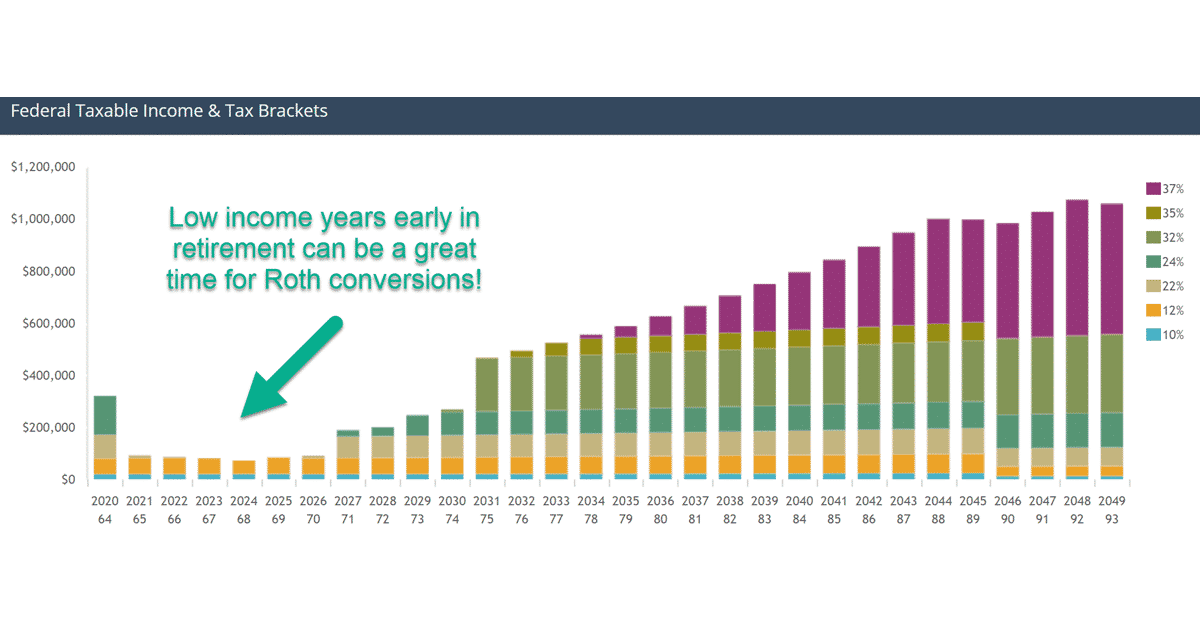

The Roth Conversion Strategy Guide for Early Retirees Route to Retire, Deadline to convert at fidelity. This process involves converting a traditional individual retirement account.

When to time your Roth IRA conversions, Use our roth ira conversion calculator to compare the estimated future values of keeping your traditional ira vs. One of the key financial strategies in 2025 is the roth ira conversion.

Is Now the Time for a Roth Conversion? Wealthramp, Tax rates are set to rise in the. Limits on roth ira contributions based on modified agi.

The deadline for a roth conversion is also different.